Title The Bailout Plan is dead, T-bills falling, ....dow crashes published to tabletswithink.

Report sent to tabletswithink. about The Bailout Plan is dead, T-bills falling, ....dow crashes

This article is located at tabletswithink.

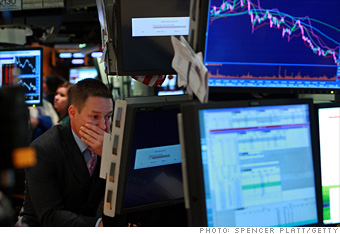

The Bailout vote has failed....T-bills falling, ....dow crashes

To make the legislation more politically palatable, the bill calls for the government, as an owner of a large number of mortgage securities, to exert influence on loan servicers to modify more troubled loans to help prevent additional foreclosures.

To make the legislation more politically palatable, the bill calls for the government, as an owner of a large number of mortgage securities, to exert influence on loan servicers to modify more troubled loans to help prevent additional foreclosures.  It also provides that the government will take equity in the firms that sell the securities to the government, and limits pay packages for top executives.

It also provides that the government will take equity in the firms that sell the securities to the government, and limits pay packages for top executives.

The legislation comes amid great upheaval in the nation's financial system. On Monday morning, the Federal Deposit Insurance Corp., which insures deposits at failed banks, arranged for the sale of the banking assets of Wachovia (WB, Fortune 500), the nation's No. 4 bank holding company, to Citigroup (C, Fortune 500) for $2.2 billion in stock.

The legislation comes amid great upheaval in the nation's financial system. On Monday morning, the Federal Deposit Insurance Corp., which insures deposits at failed banks, arranged for the sale of the banking assets of Wachovia (WB, Fortune 500), the nation's No. 4 bank holding company, to Citigroup (C, Fortune 500) for $2.2 billion in stock.

That follows three weeks of other shocks: the Treasury Department's seizure of mortgage finance firms Fannie Mae (FNM, Fortune 500) and Freddie Mac (FRE, Fortune 500); Wall Street firm Lehman Brothers' bankruptcy filing; rival Merrill Lynch (MER, Fortune 500) purchase by Bank of America (BAC, Fortune 500).

That follows three weeks of other shocks: the Treasury Department's seizure of mortgage finance firms Fannie Mae (FNM, Fortune 500) and Freddie Mac (FRE, Fortune 500); Wall Street firm Lehman Brothers' bankruptcy filing; rival Merrill Lynch (MER, Fortune 500) purchase by Bank of America (BAC, Fortune 500).

In addition, the Fed bailed out insurance giant American International Group (AIG, Fortune 500), loaning it $85 billion in return for a nearly 80% stake. while Washington Mutual (WM, Fortune 500), the nation's largest savings and loan, became the largest bank failure in history.

In addition, the Fed bailed out insurance giant American International Group (AIG, Fortune 500), loaning it $85 billion in return for a nearly 80% stake. while Washington Mutual (WM, Fortune 500), the nation's largest savings and loan, became the largest bank failure in history.

analysis

Open Letter to Congress on the Bailout Plan Mike ... Spot Gold & US 3 Month T-Bills Otto Rock 9 ... Gold Likes/Dislikes & Bouncing Dead Cats ...

more ...

go to website

Cached

Senate leader: Significant progress on bailout

... to several "key" Senators and Congressman just went "dead" ... Not my real retirement plan, though. My wife and I are ... Wants a bail out by the tax payers. Their bad business ...

more ...

go to website

Cached

WHAT REALLY HAPPENED | The History The US Government HOPES You Never ...

... of analysis of and revulsion for the Wall Street Bailout plan ... quick $105 billion injection of liquidity, the Dow ... Some analysts say the bail-out of the financial system could ...

more ...

go to website

Cached

Amid GOP revolt, bailout deal breaks down

... to several "key" Senators and Congressman just went "dead" ... Not my real retirement plan, though. My wife and I are ... Wants a bail out by the tax payers. Their bad business ...

more ...

go to website

Cached

WHAT REALLY HAPPENED | The History The US Government HOPES You Never ...

... quick $105 billion injection of liquidity, the Dow ... The Wall Street Bailout Plan, Explained ... US will struggle to pay-back some of its long-term T-bills.

more ...

go to website

Cached

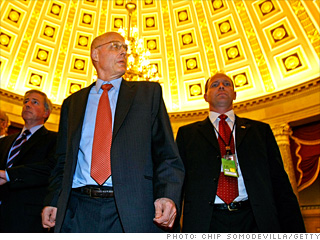

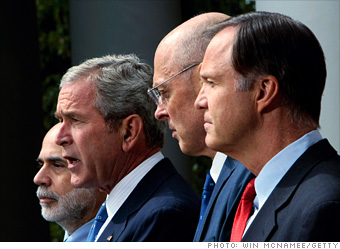

n Sunday evening, the House Republican working group, which stringently opposed earlier drafts of the plan and offered a counterproposal, indicated it would support the bill, and its members are encouraging other Republicans in the House to do the same. "Nobody wants to have to support this bill, but it's a bill that we believe will avert the crisis that's out there," House Minority Leader John Boehner, R-Ohio, told reporters. But the bill did draw some opposition during the morning debate. Rep. John Culberson, R-Texas, said the measure would leave a huge burden on taxpayers. "This legislation is giving us a choice between bankrupting our children and bankrupting a few of these big financial institutions on Wall Street that made bad decisions," he said. Other conservative Republicans argued the bill would be a blow against economic freedom. Thaddeus McCotter, R-Mich., said the bill posed a choice between the loss of prosperity in the short term or economic freedom in the long term. He said once the federal government enters the financial market place, it will not leave. "The choice is stark," he said. But there were also Democrats who opposed the bill for not doing enough to help those who taxpayers facing foreclosure or needing unemployment benefits extended, or taxing Wall Street to pay for the rescue package. "Like the Iraq war and patriot act, this bill is fueled by fear and haste," said Lloyd Doggett, D-Texas. The crisis and a proposed fix Banks and Wall Street firms, worried about both their own needs for cash and the condition of other institutions, essentially stopped loaning money to one another in recent weeks. That choked off the money being made available on Main Street in the form of mortgage loans, business loans and other consumer borrowing. The crisis stems from problems in mortgage-backed securities, which saw their value plunge as home prices have gone into their worst slide since the Great Depression and foreclosures have soared to record levels. In turn, the market for trillion of dollars worth of those securities held by major firms evaporated, sending them down to fire sale prices and raising the risk of widespread failures among the nation's major financial firms. Under the plan, Treasury will buy the mortgage backed securities, either directly from the firms or through an auction process. It may also arrange to provide guarantees for the securities up to their original values in return for premiums they would charge current holders of the securities. To make the legislation more politically palatable, the bill calls for the government, as an owner of a large number of mortgage securities, to exert influence on loan servicers to modify more troubled loans to help prevent additional foreclosures. It also provides that the government will take equity in the firms that sell the securities to the government, and limits pay packages for top executives. The legislation comes amid great upheaval in the nation's financial system. On Monday morning, the Federal Deposit Insurance Corp., which insures deposits at failed banks, arranged for the sale of the banking assets of Wachovia (WB, Fortune 500), the nation's No. 4 bank holding company, to Citigroup (C, Fortune 500) for $2.2 billion in stock. That follows three weeks of other shocks: the Treasury Department's seizure of mortgage finance firms Fannie Mae (FNM, Fortune 500) and Freddie Mac (FRE, Fortune 500); Wall Street firm Lehman Brothers' bankruptcy filing; rival Merrill Lynch (MER, Fortune 500) purchase by Bank of America (BAC, Fortune 500). In addition, the Fed bailed out insurance giant American International Group (AIG, Fortune 500), loaning it $85 billion in return for a nearly 80% stake. while Washington Mutual (WM, Fortune 500), the nation's largest savings and loan, became the largest bank failure in history.

Videos from YouTube

Title: Let's Play "WALLSTREET BAILOUT" The Rules Are... Rep Kaptur

Categories: military,economy,congress,taxcuts,gitmo,habeas,News,congresswoman,relief,mama,bush,kaptur,iraq,cheney,bill,corpus,

Published on: 9/22/2008 8:03:52 PM

Title: Palin: Bailout is about healthcare!

Categories: News,bailout,couric,news,cbs,thinkprogres,healthcare,palin,

Published on: 9/25/2008 11:25:46 AM

Title: Congressman Ron Paul Schools Bernanke on the Bailout Plan

Categories: Price,Monetary,Wall,Bail,Constitutionality,News,Bailout,Ron,Bernanke,Street,Out,Authority,Debt,Fixing,Federal,Paul,Depression,

Published on: 9/24/2008 11:32:51 AM

Title: Ron Paul Fox News 9/17/08 AIG bailout

Categories: News,Fox,Baldwin,Ron,McKinney,News,Paul,Nader,

Published on: 9/17/2008 3:23:30 PM

Title: This Is How The Bail Out Will Screw You

Categories: bad,paulson,pay,off,economy,bailou,the,henry,News,loans,money,street,john,bush,financial,treasury,loan,turks,crisis,wall,republicans,mccain,young,hank,administration,secrretary,

Published on: 9/22/2008 9:44:53 PM