Title The Bailout Plan is dead: Wall Street in despair published to tabletswithink.

Report sent to tabletswithink. about The Bailout Plan is dead: Wall Street in despair

This article is located at tabletswithink.

The Bailout vote has failed....T-bills falling, ....dow crashes

The fate of the government's $700 billion financial bailout plan was thrown into doubt Monday as the House rejected the controversial measure.

The next steps were unclear. The abrupt defeat left the Bush administration and congressional leaders scrambling to figure out whether to renegotiate the bill and introduce it again as soon as Thursday or to try other options.

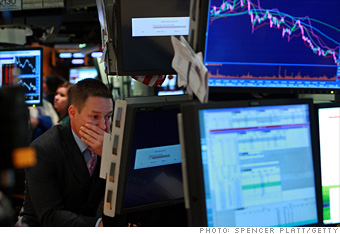

Stock markets reacted violently. Investors who had been counting on the rescue plan's passage sent the Dow Jones industrial average down well over 700 points. The stock gauge closed 778 points lower - nearly 7%. (Full coverage)

The measure, which is designed to get battered lending markets working normally again, needed 218 votes for passage. But it came up 13 votes short of that target, with a final vote of 228 to 205 against. Two-thirds of Democrats and one-third of Republicans voted for the measure.

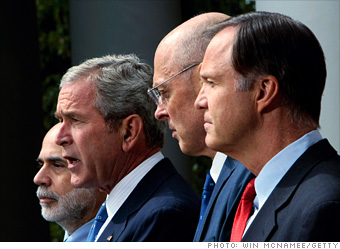

President Bush, who earlier in the day said he was confident the bill would pass, said he was "very disappointed" by the House vote. Treasury Secretary Henry Paulson, speaking at the White House, said he will continue to "use all the tools available to protect" the economy.

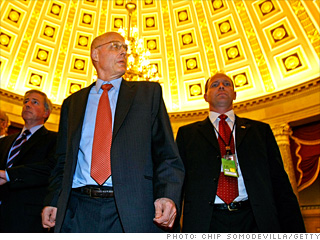

Republican leaders, who had pushed their reluctant members to vote for the bill, pointed the finger for the failure at a speech given Monday by Speaker Nancy Pelosi, D-Calif.

Pelosi, speaking on the House floor, had blamed the nation's economic problems on "failed Bush economic policies."

House minority leader John Boehner, R-Ohio, said after the vote that passage would have been possible if it had not been for Pelosi's "partisan speech."

Rep. Barney Frank, D-Mass., one of the main congressional negotiators, dismissed the GOP claim that Pelosi's speech was responsible for Republicans voting against the bill. "Because somebody hurt their feelings, they decided to hurt the country," Frank said. "That's not plausible."

'Our time has run out'

The four-hour debate that preceded Monday's vote included impassioned pleas for and against the measure from Democrats and Republicans alike. Party leaders told members that the only way to protect the economy from a spreading credit crunch was to vote for the difficult-to-swallow measure.

"Our time has run out," said Rep. Spencer Bachus, R-Ala., the ranking Republican on the House Financial Services Committee. "We're going make a decision. There are no other choices, no other alternatives."

Added Frank: "Today is the decision day. If we defeat this bill today, it will be a very bad day for the financial sector of the American economy."

Boehner told his members, many of whom objected to the measure, that they had to accept something he and many of them found distasteful.

"If I didn't think we were on the brink of an economic disaster, it would be the easiest thing to say no to this," Boehner said. But he said lawmakers needed to do what was in the best interest of the country.

One lawmaker who voted against the bill, Rep. John Culberson, R-Texas, said the measure would leave a huge burden on taxpayers. "This legislation is giving us a choice between bankrupting our children and bankrupting a few of these big financial institutions on Wall Street that made bad decisions," he said. Culberson voted against the bill.

To make the legislation more politically palatable, the bill calls for the government, as an owner of a large number of mortgage securities, to exert influence on loan servicers to modify more troubled loans to help prevent additional foreclosures.

The fate of the government's $700 billion financial bailout plan was thrown into doubt Monday as the House rejected the controversial measure.

The next steps were unclear. The abrupt defeat left the Bush administration and congressional leaders scrambling to figure out whether to renegotiate the bill and introduce it again as soon as Thursday or to try other options.

Stock markets reacted violently. Investors who had been counting on the rescue plan's passage sent the Dow Jones industrial average down well over 700 points. The stock gauge closed 778 points lower - nearly 7%. (Full coverage)

The measure, which is designed to get battered lending markets working normally again, needed 218 votes for passage. But it came up 13 votes short of that target, with a final vote of 228 to 205 against. Two-thirds of Democrats and one-third of Republicans voted for the measure.

President Bush, who earlier in the day said he was confident the bill would pass, said he was "very disappointed" by the House vote. Treasury Secretary Henry Paulson, speaking at the White House, said he will continue to "use all the tools available to protect" the economy.

Republican leaders, who had pushed their reluctant members to vote for the bill, pointed the finger for the failure at a speech given Monday by Speaker Nancy Pelosi, D-Calif.

Pelosi, speaking on the House floor, had blamed the nation's economic problems on "failed Bush economic policies."

House minority leader John Boehner, R-Ohio, said after the vote that passage would have been possible if it had not been for Pelosi's "partisan speech."

Rep. Barney Frank, D-Mass., one of the main congressional negotiators, dismissed the GOP claim that Pelosi's speech was responsible for Republicans voting against the bill. "Because somebody hurt their feelings, they decided to hurt the country," Frank said. "That's not plausible."

'Our time has run out'

The four-hour debate that preceded Monday's vote included impassioned pleas for and against the measure from Democrats and Republicans alike. Party leaders told members that the only way to protect the economy from a spreading credit crunch was to vote for the difficult-to-swallow measure.

"Our time has run out," said Rep. Spencer Bachus, R-Ala., the ranking Republican on the House Financial Services Committee. "We're going make a decision. There are no other choices, no other alternatives."

Added Frank: "Today is the decision day. If we defeat this bill today, it will be a very bad day for the financial sector of the American economy."

Boehner told his members, many of whom objected to the measure, that they had to accept something he and many of them found distasteful.

"If I didn't think we were on the brink of an economic disaster, it would be the easiest thing to say no to this," Boehner said. But he said lawmakers needed to do what was in the best interest of the country.

One lawmaker who voted against the bill, Rep. John Culberson, R-Texas, said the measure would leave a huge burden on taxpayers. "This legislation is giving us a choice between bankrupting our children and bankrupting a few of these big financial institutions on Wall Street that made bad decisions," he said. Culberson voted against the bill.

To make the legislation more politically palatable, the bill calls for the government, as an owner of a large number of mortgage securities, to exert influence on loan servicers to modify more troubled loans to help prevent additional foreclosures.  It also provides that the government will take equity in the firms that sell the securities to the government, and limits pay packages for top executives.

It also provides that the government will take equity in the firms that sell the securities to the government, and limits pay packages for top executives.

The legislation comes amid great upheaval in the nation's financial system. On Monday morning, the Federal Deposit Insurance Corp., which insures deposits at failed banks, arranged for the sale of the banking assets of Wachovia (WB, Fortune 500), the nation's No. 4 bank holding company, to Citigroup (C, Fortune 500) for $2.2 billion in stock.

The legislation comes amid great upheaval in the nation's financial system. On Monday morning, the Federal Deposit Insurance Corp., which insures deposits at failed banks, arranged for the sale of the banking assets of Wachovia (WB, Fortune 500), the nation's No. 4 bank holding company, to Citigroup (C, Fortune 500) for $2.2 billion in stock.

That follows three weeks of other shocks: the Treasury Department's seizure of mortgage finance firms Fannie Mae (FNM, Fortune 500) and Freddie Mac (FRE, Fortune 500); Wall Street firm Lehman Brothers' bankruptcy filing; rival Merrill Lynch (MER, Fortune 500) purchase by Bank of America (BAC, Fortune 500).

That follows three weeks of other shocks: the Treasury Department's seizure of mortgage finance firms Fannie Mae (FNM, Fortune 500) and Freddie Mac (FRE, Fortune 500); Wall Street firm Lehman Brothers' bankruptcy filing; rival Merrill Lynch (MER, Fortune 500) purchase by Bank of America (BAC, Fortune 500).

In addition, the Fed bailed out insurance giant American International Group (AIG, Fortune 500), loaning it $85 billion in return for a nearly 80% stake. while Washington Mutual (WM, Fortune 500), the nation's largest savings and loan, became the largest bank failure in history.

In addition, the Fed bailed out insurance giant American International Group (AIG, Fortune 500), loaning it $85 billion in return for a nearly 80% stake. while Washington Mutual (WM, Fortune 500), the nation's largest savings and loan, became the largest bank failure in history.

Nightmare on Wall Street: 72 hours that shook the world's economy

... warned that there will be no government bail-out. ... Across Wall Street, Lehman is being called a 'dead bank walking'. ... It announces it plans to move capital from its ...

more ...

go to website

Wall Street's old hands not rattled by crisis

Wall Street's old hands not rattled by crisis ... 700B bailout plan breaks apart; talks to continue Report: ... center lay in literal ruins, with thousands dead from a ...

more ...

go to website

Cached

Street Scenes from a Lehman Bailout: Executives Gather at NY Fed

... stone and iron headquarters in lower Manhattan, Wall Street ... if the FED and SEC along with all banks draft a plan for ... Lehman hepled bail out LTCM in 1998 (their share was $100 ...

more ...

go to website

Cached

Wall Street fallout shakes economy

Inflation rises from the dead (July 2008) Inflation: ... Don't despair, crisis is no Great Depression ... morning to discuss an expected $700-billion bailout plan for Wall Street.

more ...

go to website

Cached

Wall Street's old hands not rattled by crisis - Yahoo! News

Images of Wall Street's stunning stumble were everywhere this ... center lay in literal ruins, with thousands dead from a ... in US history AP; A bad day for the GOP on politics, bailout plan ...

more ...

go to website

Cached

Stocks plummet as House votes down bailout; Dow drops 778

Demonstrators protest the proposed $700 billion Wall Street bailout in front of ... Exchange watched on TV screens as the House voted down the plan, and as they saw stock prices tumbling on their monitors.

more ...

go to website

Source: USA Today

NewsDateTime: 2 hours ago

McCain Fatigue, and a Painful Palin

I have never seen such despair and agony on the Republican side. ... I hear that inhaling so much sand can make you brain dead. ... country needs is lowering of taxes in the midst of a tax-payer funded Wall street bailout.

more ...

go to website

Source: New York Times Blogs

NewsDateTime: 9/25/2008

Lingua publica

McCain for these problems [on Wall Street], but I do fault the economic philosophy he ... T]he federal government announced a massive plan to bail out a number of ... Congress' move to bailout lenders and borrowers who made poor decisions will ...

more ...

go to website

Source: Enter Stage Right

NewsDateTime: 20 hours ago

Raining on Obama and Biden's Parade

Obama Slams McCain for a 'Katrina Like' Response to the Bailout Bill 'Un-American ... Admiral Mullen and Obama's Iraq Plan Fact Check: Obama Misleads on $250,000 Tax Claim ... September 27, 2008 8:48 PM ABC’s Sunlen Miller, Matt Jaffe, and John Berman ...

more ...

go to website

Source: ABC News Blogs

NewsDateTime: 9/27/2008

Campaign Says Palin Won't Make 'SNL' Cameo

Admiral Mullen and Obama's Iraq Plan Fact Check: Obama Misleads on $250,000 Tax ... like the Debate, McCain's fake campaign suspension and then messing up the bailout ... He reminds me of the guy on the street corner with a soap box preaching that the ...

more ...

go to website

Source: ABC News Blogs

NewsDateTime: 9/27/2008

n Sunday evening, the House Republican working group, which stringently opposed earlier drafts of the plan and offered a counterproposal, indicated it would support the bill, and its members are encouraging other Republicans in the House to do the same. "Nobody wants to have to support this bill, but it's a bill that we believe will avert the crisis that's out there," House Minority Leader John Boehner, R-Ohio, told reporters. But the bill did draw some opposition during the morning debate. Rep. John Culberson, R-Texas, said the measure would leave a huge burden on taxpayers. "This legislation is giving us a choice between bankrupting our children and bankrupting a few of these big financial institutions on Wall Street that made bad decisions," he said. Other conservative Republicans argued the bill would be a blow against economic freedom. Thaddeus McCotter, R-Mich., said the bill posed a choice between the loss of prosperity in the short term or economic freedom in the long term. He said once the federal government enters the financial market place, it will not leave. "The choice is stark," he said. But there were also Democrats who opposed the bill for not doing enough to help those who taxpayers facing foreclosure or needing unemployment benefits extended, or taxing Wall Street to pay for the rescue package. "Like the Iraq war and patriot act, this bill is fueled by fear and haste," said Lloyd Doggett, D-Texas. The crisis and a proposed fix Banks and Wall Street firms, worried about both their own needs for cash and the condition of other institutions, essentially stopped loaning money to one another in recent weeks. That choked off the money being made available on Main Street in the form of mortgage loans, business loans and other consumer borrowing. The crisis stems from problems in mortgage-backed securities, which saw their value plunge as home prices have gone into their worst slide since the Great Depression and foreclosures have soared to record levels. In turn, the market for trillion of dollars worth of those securities held by major firms evaporated, sending them down to fire sale prices and raising the risk of widespread failures among the nation's major financial firms. Under the plan, Treasury will buy the mortgage backed securities, either directly from the firms or through an auction process. It may also arrange to provide guarantees for the securities up to their original values in return for premiums they would charge current holders of the securities. To make the legislation more politically palatable, the bill calls for the government, as an owner of a large number of mortgage securities, to exert influence on loan servicers to modify more troubled loans to help prevent additional foreclosures. It also provides that the government will take equity in the firms that sell the securities to the government, and limits pay packages for top executives. The legislation comes amid great upheaval in the nation's financial system. On Monday morning, the Federal Deposit Insurance Corp., which insures deposits at failed banks, arranged for the sale of the banking assets of Wachovia (WB, Fortune 500), the nation's No. 4 bank holding company, to Citigroup (C, Fortune 500) for $2.2 billion in stock. That follows three weeks of other shocks: the Treasury Department's seizure of mortgage finance firms Fannie Mae (FNM, Fortune 500) and Freddie Mac (FRE, Fortune 500); Wall Street firm Lehman Brothers' bankruptcy filing; rival Merrill Lynch (MER, Fortune 500) purchase by Bank of America (BAC, Fortune 500). In addition, the Fed bailed out insurance giant American International Group (AIG, Fortune 500), loaning it $85 billion in return for a nearly 80% stake. while Washington Mutual (WM, Fortune 500), the nation's largest savings and loan, became the largest bank failure in history.

Videos from YouTube

Title: Palin: Bailout is about healthcare!

Categories: News,bailout,couric,news,cbs,thinkprogres,healthcare,palin,

Published on: 9/25/2008 11:25:46 AM

Title: Go Viral: STOP THE BAILOUT OR.... DEPRESSION?

Categories: $700,News,bailout,commentary,billion,news,grassroots,depression,outreach,analysis,

Published on: 9/27/2008 4:23:10 PM

Title: Congressman Ron Paul Schools Bernanke on the Bailout Plan

Categories: Price,Monetary,Wall,Bail,Constitutionality,News,Bailout,Ron,Bernanke,Street,Out,Authority,Debt,Fixing,Federal,Paul,Depression,

Published on: 9/24/2008 11:32:51 AM

Title: Let's Play "WALLSTREET BAILOUT" The Rules Are... Rep Kaptur

Categories: military,economy,congress,taxcuts,gitmo,habeas,News,congresswoman,relief,mama,bush,kaptur,iraq,cheney,bill,corpus,

Published on: 9/22/2008 8:03:52 PM

Title: Ron Paul Fox News 9/17/08 AIG bailout

Categories: News,Fox,Baldwin,Ron,McKinney,News,Paul,Nader,

Published on: 9/17/2008 3:23:30 PM